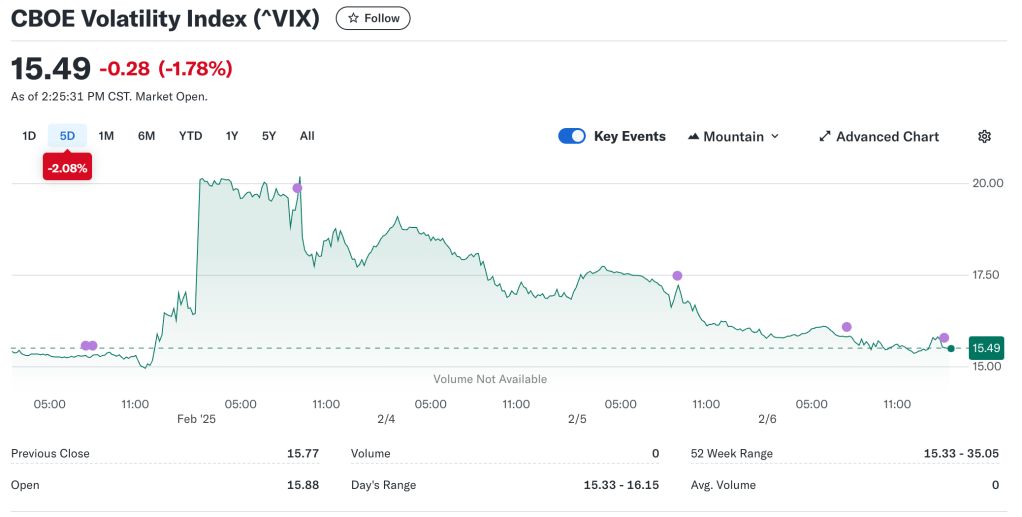

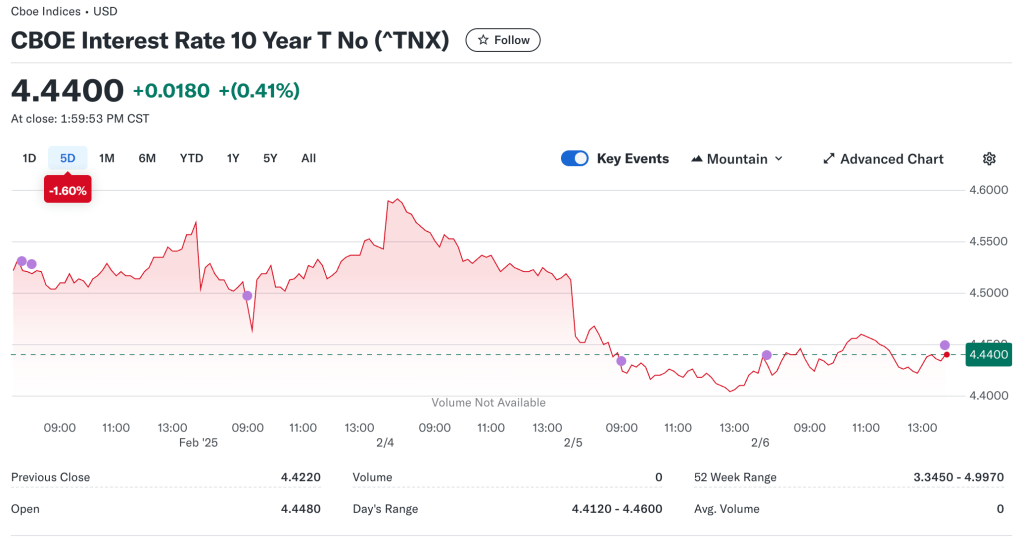

Okay, sweet. The proposed 25% tariffs on all Mexican and Canadian goods (with carve-outs for Canadian energy) were postponed by a month. This is undoubtedly good news. To Trump’s credit, he was able to get seeming concessions from our neighbors. He first called Mexican President Claudia Sheinbaum wherein she agreed to send thousands of troops to the border to help curb illegal immigration and the smuggling of fentanyl. In return, the US vowed to help limit the amount of guns funneling into Mexico. Similarly, Trump called Canadian Prime Minister Justin Trudeau striking a deal to delay the tariffs. Trudeau promised to “ensure 24/7 eyes on the border” (to deal with the ‘problem’ of fentanyl from the northern border) and pledged $1.3 billion to that end, as well as agreeing to a US-Canada joint strike force to tackle organized crime. The CBOE volatility index initially jumped slightly as we approached implementation but has since tapered off – so too have long-term interest rates. This reversion reflects the general sentiment of the situation – crisis averted, at least for now.

The long-term implications of these last-minute deals are unclear. Now that Trump has succeeded in scaring Mexico and Canada into an agreement, will he become more emboldened next time around? As the tariff moratorium comes to a close, will he demand even more from other countries? How much are these countries willing to take? I’m not going to pretend to know what Trump is going to do. However, given that he just implemented 10% tariffs on all Chinese imports, I think the probability of future tariffs is significant. And, even though tariffs on Mexico and Canada were delayed, there was an excellent Bloomberg piece claiming that Mexico in particular is hurt by these threats even if they aren’t executed. The extent of the pain is decidedly mitigated, but the incentive to funnel foreign direct investment and resources into Mexico is diminished with the threat of tariffs and the deterioration of the US-Mexico-Canada (USMCA) agreement. Regardless, let’s talk more about the tariffs on China.

There is a significant imbalance between the magnitude of the US and China’s tariffs. The US placed 10% tariffs on China across the board. This affects $525 billion of US imports, which accounts for ~14% of Chinese exports and ~3% of their total GDP. Conversely, China assumed a more tepid approach, placing 10-15% levies on roughly 80 US energy products and agricultural tools. These affect $14B of imports, account for 0.72% of US imports and 0.05% of total GDP (import data from Bloomberg, who sourced it from China Customs). China also added export restrictions on tungsten and other metals predominantly used in the electronic, aviation, and defense industries. In sum, the US is taxing China far more than China is taxing the US. As far as China’s response goes, their export restrictions will likely hamper production in the aforementioned industries while their tariffs should increase prices by a small but unknown magnitude. How much? I don’t know but it doesn’t seem like a drastic effect. Nonetheless, if this trade war continues to escalate, these effects will decidedly be felt by the everyday consumer.

The tariffs that the US erected are a different, more consequential story. China’s response was measured and relatively light, thus the expected drag on growth should be tame. The lack of tariffs keeps the average price level of US goods and services roughly constant, neither incentivizing nor disincentivizing the purchase of exports. However, our decision to impose tariffs should increase the prices of Chinese exports by a non-negligible amount. As stated, the US is applying 10% tariffs on 14% of our total imports. This is crazy. How much do these price increases matter? As shown below, both headline and core PCE inflation have been hovering somewhat near the Federal Reserve’s 2% target, with core inflation stagnating in recent months and headline increasing.

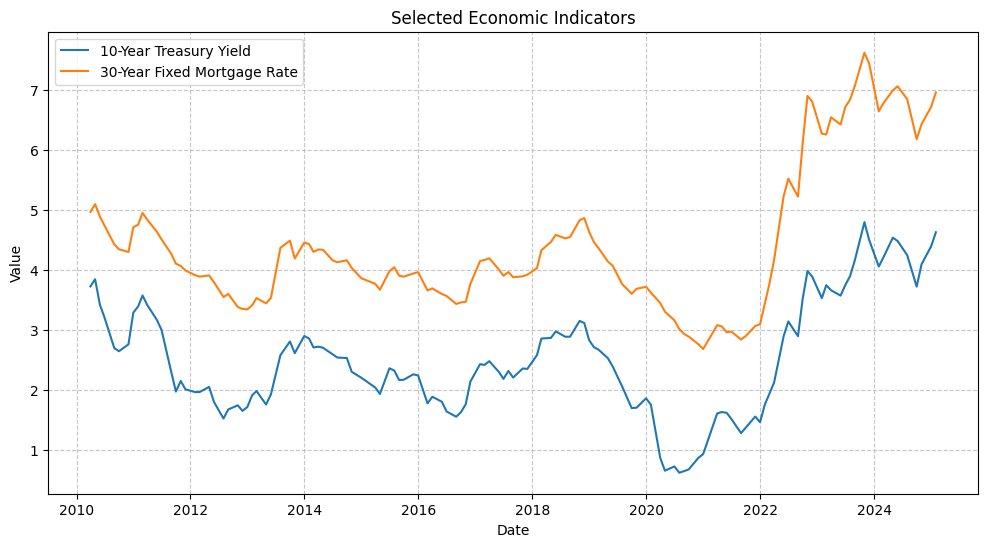

Anything that risks increasing inflation – in our case, tariffs on China increasing prices – pressures the Federal Reserve to keep rates higher for longer. Core inflation holding steady implies the underlying, persistent rate of price increases (removing the typically volatile food and energy components) is growing at a steady pace. The Federal Reserve wants to see more progress towards its target but is in a state of limbo. As Federal Reserve President Jerome Powell stated in his Jan 29 press conference, “Inflation has moved much closer to our 2 percent longer-run goal, though it remains somewhat elevated… the Federal Open Market Committee decided to leave our policy interest rate unchanged and to continue to reduce our securities holdings.” That is, they have decided to keep short-term interest rates constant while continuing to engage in quantitative tightening. If tariff-induced inflation becomes a significant problem, Powell and co. will be forced to keep rates high to keep the economy from overheating and inflation from spiraling.

What I’m getting at is simple: not only will these tariffs increase inflation, but also interest rates by way of expectations of the Federal Reserve. If credit card APR, mortgage rates, auto loans, any other variable loan, or wealth discounting matters to you, then Trump’s tariffs hurt you. The extent of this hurt is controlled for now but might expand in the future.